How credit card rewards really work has been this total mind-bender for me lately. Like, I’m sitting here in my apartment in Chicago—it’s January, freezing outside, I’ve got my space heater blasting and a half-eaten pizza from last night on the counter—and I’m staring at my phone going, wait, these points are supposed to be free money? Seriously?

I got into credit card rewards a couple years ago because everyone on TikTok was bragging about free flights and stuff. My first card was this basic cash back one, and I thought I was killing it. Earn 1-2% on everything, easy peasy. But then I started digging deeper, and oh man, how credit card rewards really work is way more layered than that. Banks aren’t just handing out freebies outta kindness—they make bank on merchant fees and interest from folks who carry balances. According to NerdWallet, a lot of the funding for these rewards comes from those interchange fees merchants pay, plus yeah, interest from revolving debt.

Why I Got Hooked on Credit Card Rewards (And Regretted It At First)

Anyway, fast forward—I upgraded to a points card last year thinking I’d game the system. Signed up for one with a big welcome bonus, spent like a maniac to hit the minimum, got the points… and then let them sit there. Dumb move. I was hoarding them for some dream trip, but programs can devalue points whenever, like Bankrate warns about. My credit card rewards felt like this tease—earn earn earn, but if you don’t redeem smart, poof.

Here’s a pic from when I was first overwhelmed, juggling cards trying to figure bonus categories:

The Basics: How Credit Card Rewards Really Work Under the Hood

Okay, beginner style: There are three main types—cash back (straight money), points (flexible but variable value), and miles (mostly travel). Cash back is simplest; you spend, get a percentage back. Points and miles? You earn X per dollar, usually more in bonus categories like groceries or travel.

For example, flat-rate cards give the same everywhere—super easy for newbies. But bonus category ones? That’s where credit card rewards get juicy, like 5% on gas or dining. I switched to one with rotating categories, and at first I forgot to activate—lost out on hundreds probably. Classic me.

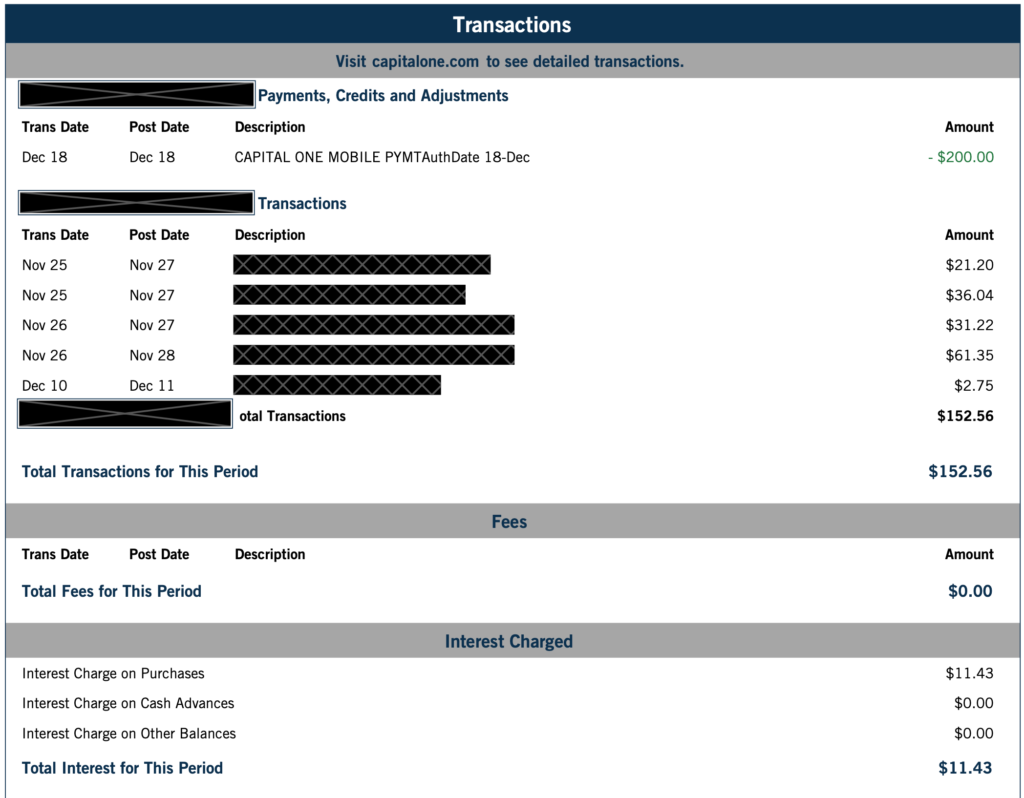

Check your statement to see it in action—mine always surprises me with how little or much piled up:

Pro tip from my screw-ups: Always pay in full. Interest wipes out rewards fast—I’ve had months where I carried a balance for “emergencies” and yeah, regretted it big time.

Redeeming Credit Card Rewards: Where the Magic (Or Disappointment) Happens

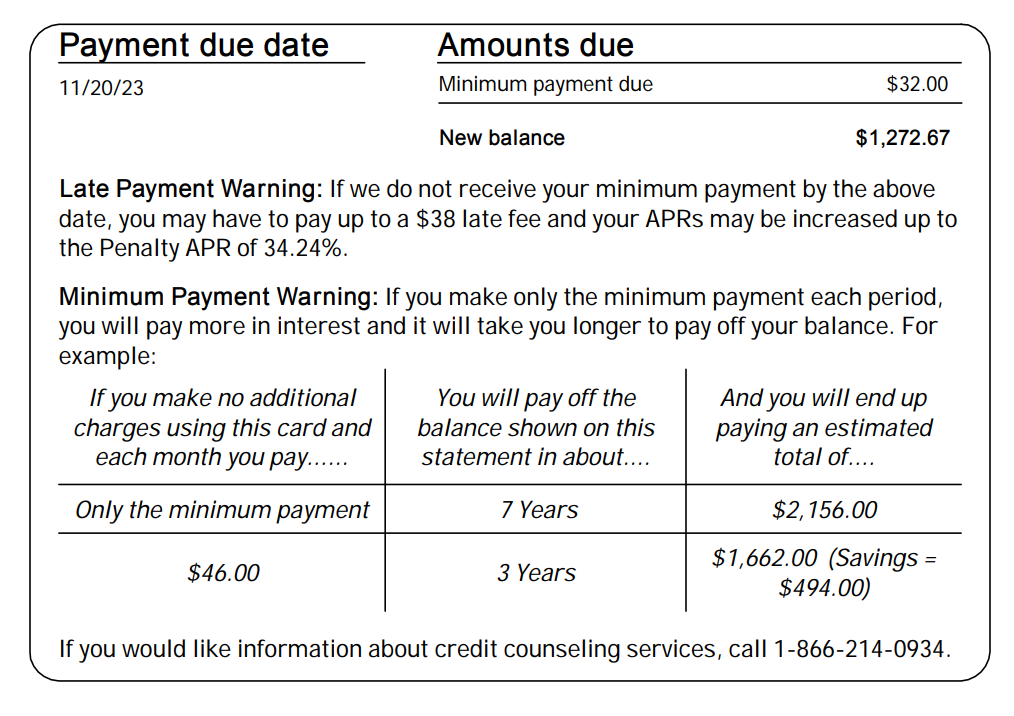

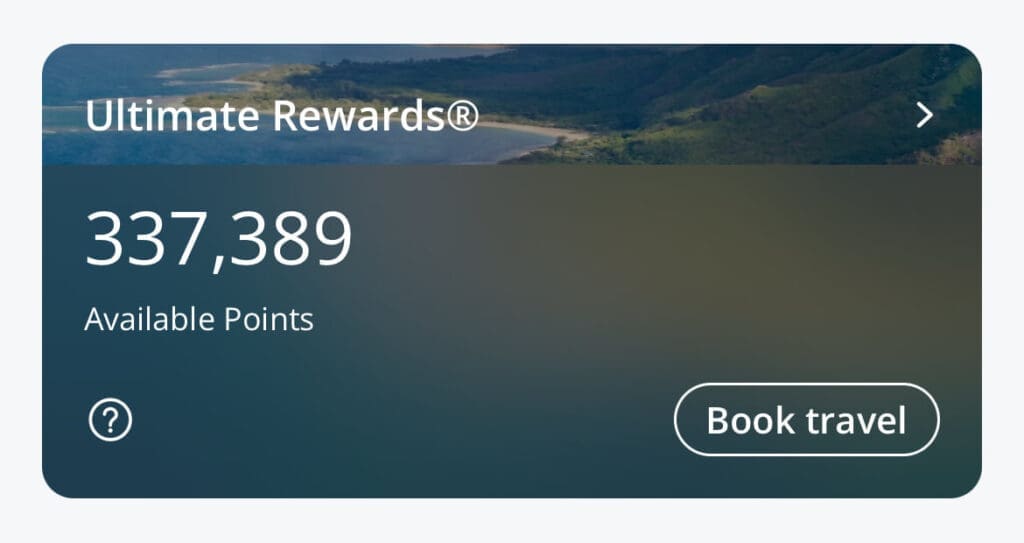

This is the fun part, but also where I messed up most. Cash back? Redeem as statement credit or deposit—easy. Points? Travel portals, transfers to airlines/hotels (often best value), or gift cards (usually worse).

I once redeemed for Amazon credit at like 0.8 cents per point—total ripoff. Now I aim for travel transfers; got a flight super cheap last summer. Here’s what it looked like when I finally redeemed right:

And cash back redemptions feel so satisfying stacked up:

My Biggest Credit Card Rewards Mistakes (So You Don’t Repeat Them)

Look, I’m no expert—just a regular dude who’s learned the hard way.

- Chasing bonuses without planning spending—racked up stuff I didn’t need.

- Ignoring annual fees at first; one card’s fee ate my rewards until I downgraded.

- Not matching card to my life; I eat out a ton, so dining bonuses are gold now.

- Forgetting perks like travel insurance—missed claiming once.

The Points Guy has great breakdowns on avoiding these pitfalls (linked here: https://thepointsguy.com/credit-cards/what-is-a-rewards-credit-card/).

Bankrate explains the types super clearly too: https://www.bankrate.com/credit-cards/rewards/types-of-rewards-credit-cards/.

Wrapping This Up: My Take on Credit Card Rewards Today

Honestly, credit card rewards really work best when you’re responsible—pay off monthly, pick cards that fit your spending, redeem often. I’ve gone from skeptical to cautiously obsessed; scored some free trips and cash that feels like a win. But it’s not free money—it’s a game with rules.

If you’re starting out, grab a simple cash back card, build habits, then level up. Check out beginner picks on CNBC Select for current offers: https://www.cnbc.com/select/best-rewards-credit-cards/.

What’s your experience? Drop a comment if you’ve got horror stories or wins—I love hearing I’m not alone in the chaos. Anyway, stay warm out there if you’re in the US like me. Peace.