Amex vs Visa vs MasterCard comparison has been messing with my head for years, seriously. Like, right now I’m sitting here in my messy apartment in Brooklyn—it’s January, freezing outside, I’ve got a half-eaten pizza from last night staring at me, and my wallet’s bulging with cards because I can’t decide. I started with a basic Visa back in college, then got sucked into Amex perks, and now I’ve got MasterCards too. It’s chaotic, okay?

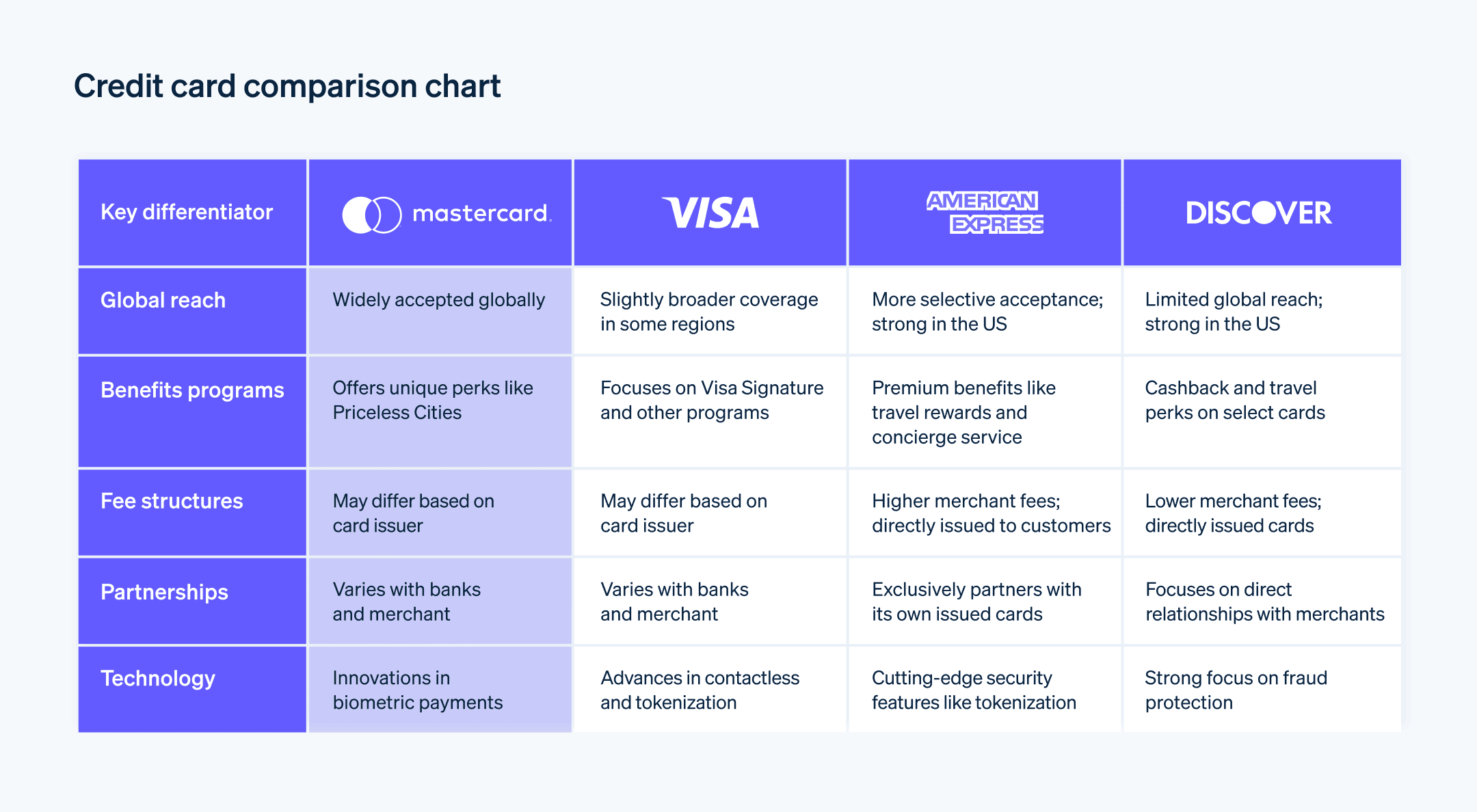

Anyway, the real deal is they’re not the same at all. Visa and MasterCard are basically just the pipes—the networks that make payments happen everywhere. They don’t issue the cards themselves; banks like Chase or Capital One do that. Amex? They’re both the network and the issuer, which means they control everything, from rewards to approvals. That’s why Amex feels fancier but pickier.

My Biggest Screw-Ups with Amex vs Visa vs MasterCard Acceptance

Look, acceptance is where I got burned the most in this Amex vs Visa vs MasterCard thing. In the US, it’s pretty much a tie now—Amex hits 99% of spots just like Visa and MasterCard, according to places like Upgraded Points. But internationally? Oof. I went to Europe a couple years back with mostly Amex, thinking I was ballin’ with those lounge perks, and half the small cafes or markets were like “no Amex.” Had to scramble for my backup Visa. Embarrassing, tbh.

Image Details: Real-life shot of someone swiping a card at a small store counter, with visible Amex, Visa, and MasterCard stickers on the terminal—kinda gritty angle from my perspective, like I’m the awkward customer waiting in line, highlighting that “will it work?” anxiety.

- Visa wins for everywhere: Accepted in 200+ countries, no drama.

- MasterCard close second: 210+ countries, basically the same vibe.

- Amex lags abroad: Around 160-200 countries, but spotty at smaller spots because merchants hate the higher fees (Amex charges 2.5-3.5%, vs Visa/MC’s 1.5-2.6% or so—check Bankrate for details).

I learned the hard way: always carry a Visa or MasterCard backup if you’re traveling.

Rewards and Perks: Where Amex vs Visa vs MasterCard Gets Juicy (and Expensive)

This is why I keep flipping in my Amex vs Visa vs MasterCard comparison—rewards. Amex straight-up crushes for luxury stuff. Their Membership Rewards? Transfer to airlines, get lounge access, hotel credits. I once used my Platinum for Centurion Lounge—free food, showers, felt like a king after a delayed flight. But that annual fee? $695 now, kills me every renewal.

Visa and MasterCard? Rewards come from the bank, not the network. So you can get killer no-fee cards with 2-5% cash back on everything.

Image Details: Glossy close-up of an Amex Platinum with airport lounge blur in background, or someone redeeming travel perks—personal vibe like I’m daydreaming about that next trip I can’t quite afford yet.

My take:

- Amex for big spenders/travelers: Insane points on flights/hotels, but you gotta pay in full monthly (charge card style often).

- Visa/MasterCard for everyday: Easier no-fee options, broader bonuses.

I racked up debt once chasing Amex points on dumb stuff—lesson learned, pay off monthly or it’s not worth it.

Fees, Approval, and My Flawed Amex vs Visa vs MasterCard Opinions

Approval? Amex is snobby—needs good/excellent credit. I got denied early on, stung bad. Visa/MasterCard? Way more forgiving, even fair credit options.

Fees: Amex premium cards hit hard with annuals, but if you use perks, it offsets (Forbes says high-spenders win). Visa/MC can be free forever.

Side-by-side comparison charts of features—my angle like I’m scribbling notes on a napkin, messy and real, showing acceptance rates, rewards examples.

Everyday spending shots, like groceries or gas with a plain Visa/MC—relatable chaos, coffee spill nearby.

Honestly, I contradict myself: love Amex perks but hate the fees and rejection vibes. Visa/MC feel safe, boring reliable.

Wrapping This Amex vs Visa vs MasterCard Ramble

Look, no perfect winner in Amex vs Visa vs MasterCard—depends on you. Me? I carry all three now, like a hoarder. If you’re everyday spending in the US, grab a solid Visa or MasterCard. Travel a lot and got the credit/discipline? Dip into Amex.

Check your spending, pull your credit report, and pick what fits your messy life. Hit up sites like WalletHub or Upgraded Points for latest deals. What’s your setup? Drop a comment if you’re team one or the other—let’s chat. Stay warm out there.