Best credit cards are kinda overwhelming, right? Like, seriously, I’ve been down this rabbit hole way too many times, staring at my wallet here in my messy home office in suburban Chicago – coffee mug half-empty, snow piling up outside the window in early January 2026 – wondering why I ever thought that shiny premium card was gonna change my life. Anyway, best credit cards for rewards and perks depend so much on your life, but I’ll spill my unfiltered thoughts based on what I’ve actually used (and regretted).

Why I’m Obsessing Over the Best Credit Cards Again This Year

Look, I gotta be real – last year I got suckered into a couple premium cards thinking the perks would make me feel fancy. Spoiler: one of ’em just sat in my drawer collecting dust while the annual fee hit like a gut punch. But the best credit cards for me now? The ones that quietly rack up cash back on my dumb grocery runs or the random flights I book to escape this Midwest winter. I’ve learned the hard way that comparing top rewards credit cards means looking at your actual spending, not the hype.

My Biggest Mistake with Premium Credit Cards Perks (and Fees)

Okay, embarrassing story time: Back in 2024, I grabbed this ultra-premium travel card because everyone was raving about the lounge access. Fast forward to me, stuck in O’Hare with a delayed flight, realizing I’d only used the lounge twice all year. The fee? Ouch. Like, $700+ gone. Now in 2026, I’m way more honest with myself – if I’m not traveling monthly, those luxury perks are just pretty illusions. But hey, for some of y’all jet-setters, the best credit cards with high fees totally pay off.

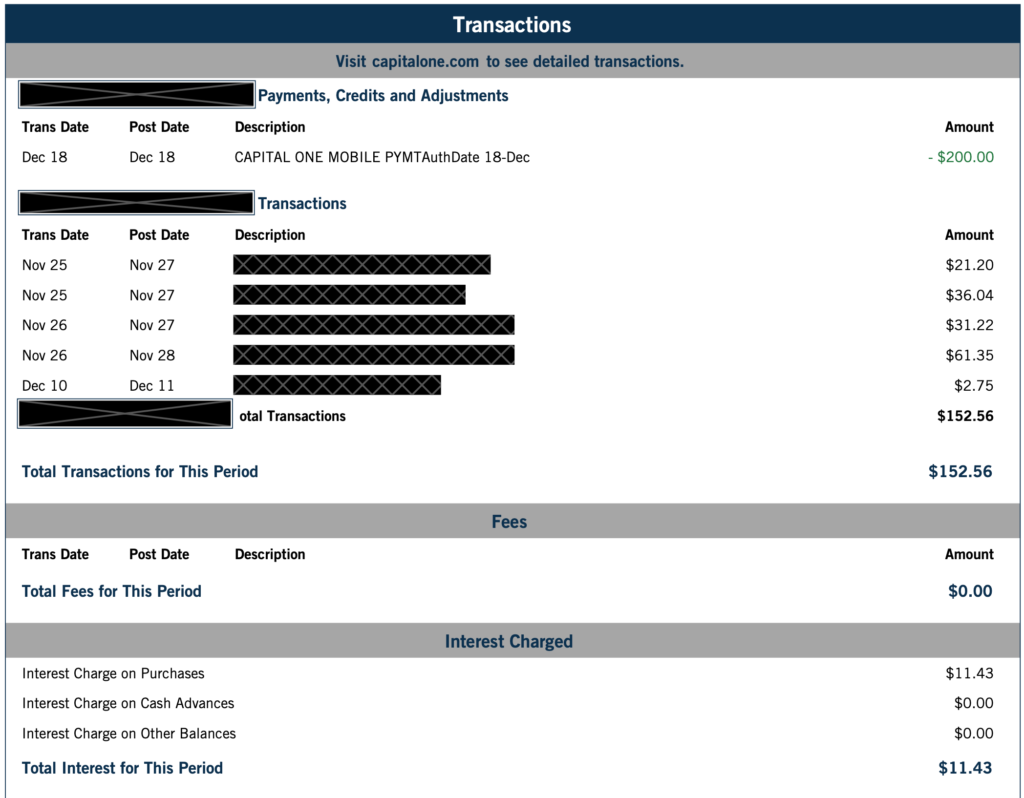

[Insert Image Placeholder]: A close-up, slightly tilted personal shot of a credit card statement on a cluttered kitchen table, highlighting cash back rewards lines with my handwritten notes in the margins like “finally!” and a coffee ring stain – descriptive alt text: “My real credit card statement showing actual cash back rewards earned from everyday spending.”

Top Rewards Credit Cards: My Hands-On Comparison for 2026

Here’s where I break down the best credit cards I’ve tried or researched hard this year. I focused on a mix – some no-fee heroes, some premium beasts that might be worth the sting.

Best No-Annual-Fee Picks for Everyday Rewards

- Wells Fargo Active Cash® Card: Unlimited 2% cash back on everything? Yes please. No fee, simple as that. I switched a bunch of bills to this and it’s been my lazy-day winner.

- Chase Freedom Unlimited®: 5% on travel through Chase, 3% dining and drugstores, 1.5% everywhere else. Pairs killer with other Chase cards if you’re into that ecosystem. My take: the bonus categories saved me on takeout binges.

Best Travel Rewards Cards That Actually Feel Worth It

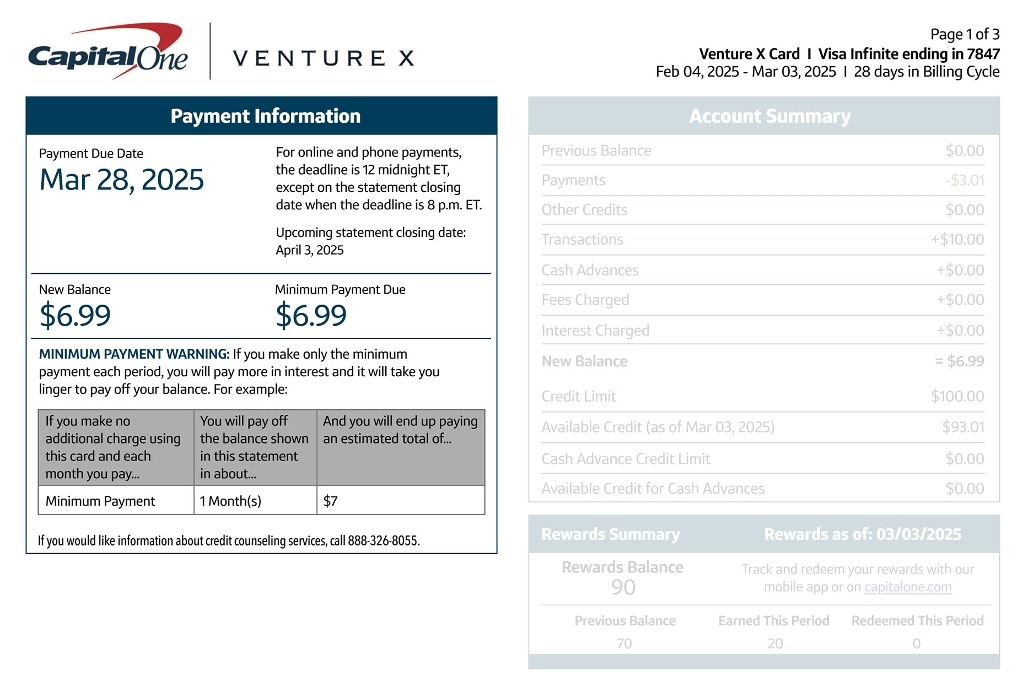

- Capital One Venture X Rewards Credit Card: $395 fee, but that $300 travel credit basically wipes it out if you book through their portal. Lounge access is legit – I finally used it on a trip to Florida last month and felt like a boss. 10x on hotels/cars through portal, 2x everywhere. For frequent-ish travelers, this is one of the best credit cards in 2026.

- Chase Sapphire Preferred® Card: $95 fee, but 5x on travel through Chase, transferable points that can stretch far. I redeemed some for a family flight and it was surprisingly easy.

Candid, from-my-perspective shot of someone (me?) swiping a card at an airport check-in kiosk, with blurred background chaos of travelers and a subtle overlay of reward points popping up – descriptive alt text: “Me swiping my travel rewards card at the airport, finally cashing in those perks.

Premium Cards: When the Fees and Perks Balance Out (Or Don’t)

- The Platinum Card® from American Express: Steep fee, tons of credits (airlines, hotels, Uber). If you max ’em, it’s worth it – but I didn’t, and yeah, that hurt.

- Chase Sapphire Reserve®: Upgraded perks in 2025 made the higher fee debatable, but that $300 travel credit is flexible gold.

[Insert Image Placeholder]: An unusual low-angle shot of a stack of heavy metal premium credit cards on a wooden desk, with one slightly sliding off like it’s escaping the pile, my phone nearby showing a fee notification – descriptive alt text: “My stack of premium metal credit cards, looking fancy but reminding me of those annual fees.”

![Best Premium and Luxury Credit Cards [January 2026]](https://upgradedpoints.com/wp-content/uploads/2022/09/Amex-Credit-Cards-and-Chase-Credit-Cards-Upgraded-Points-LLC-Large.jpg?auto=webp&disable=upscale&width=1200)

Final Thoughts: Picking Your Best Credit Cards in 2026

Man, after all this comparing top rewards credit cards, I’m sticking to a simple setup – one solid cash back, one travel if I ramp up trips. Don’t chase perks you won’t use; that’s my big lesson. Be brutally honest about your spending, like I finally am sitting here with my lukewarm coffee.

If you’re like me and wanna dip your toe, start with a no-fee card and see what rewards feel like. Or hey, check out sites like NerdWallet or The Points Guy for deeper dives – they helped me avoid more mistakes. What’s your go-to card right now? Drop it in the comments; maybe you’ll save me from my next impulse apply. Stay smart out there.